The Brexit vote is in full swing, and we should have an inclination of the results by midnight. The official announcement will arrive between 5:00-6:00 AM EST. Britain will probably remain in the EU, and I think money will start flowing back into stocks and the “risk on” trade might resume. There could always be a surprise and markets don’t always react as anticipated. We should have a good idea where we stand ahead of tomorrow’s open, and I’ll update in the AM.

-US DOLLAR- The dollar broke below the 93.38 low today, and it’s at risk of a major breakdown. Prices can accelerate downward with a no vote for the Brexit; the Euro should recover.

-GOLD- Prices are testing at the 20/50-day moving averages ahead of the Brexit outcome. A no vote should see money flow back into stock markets in search of yield (risk-on), and safe havens like gold may flounder.

-SILVER- Prices moved little before the Brexit decision. We should have a good idea regarding the outcome by 11:30 PM EST and an official announcement by 5:00 AM EST.

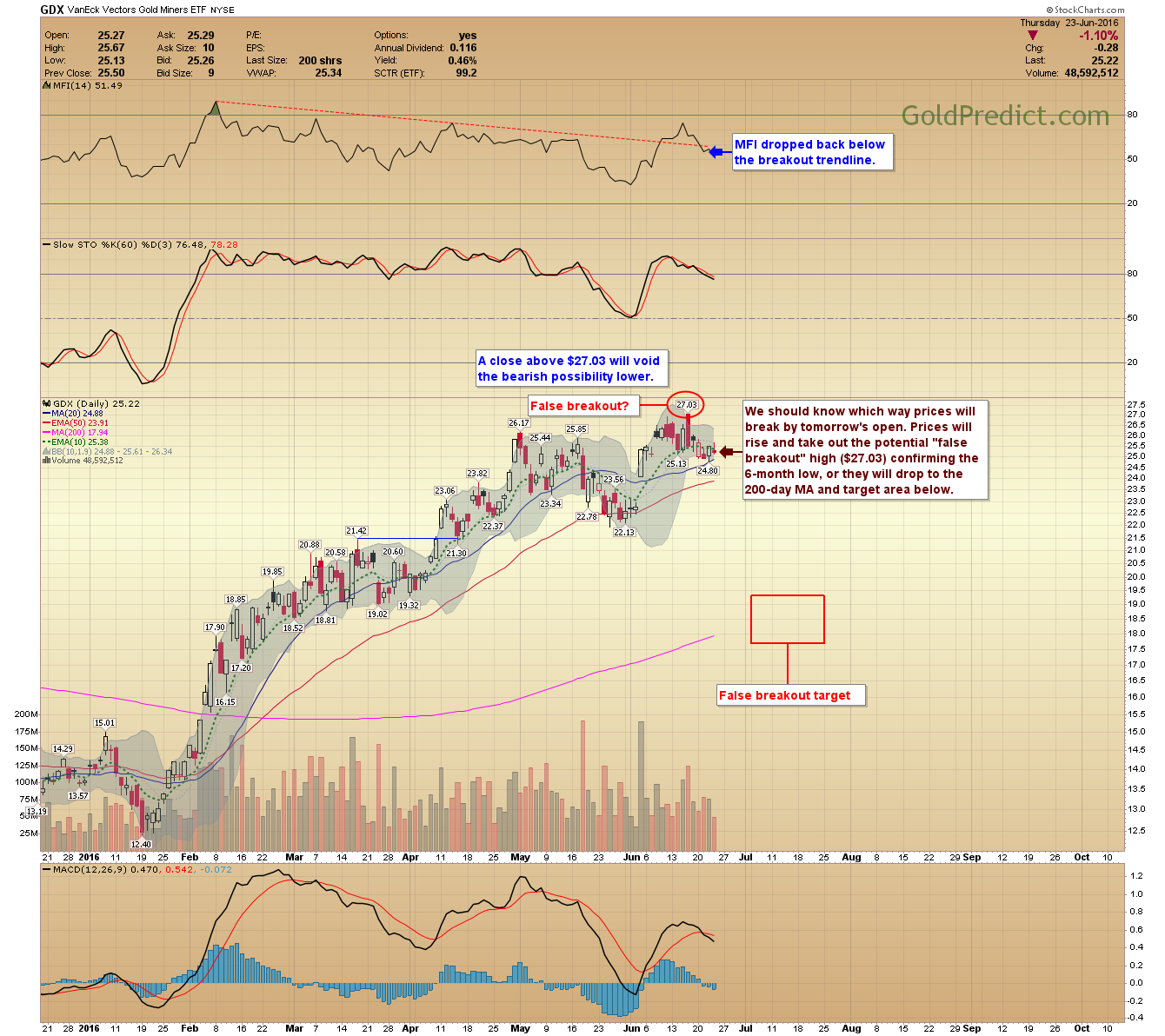

-GDX- We should know which way prices will break by tomorrow’s open. Prices will rise and take out the potential “false breakout” high ($27.03) confirming the 6-month low, OR they will drop to the 200-day MA and target area below.

-GDXJ- Junior miners are riding the 10-day EMA in somewhat of a bear flag configuration. It’s likely just indecision before the vote, but these patterns often break lower.

-SPY- Stocks headed higher today and if my theory about money flowing into stocks (risk on trade) is correct prices could breakout to new highs relatively soon.

-WTIC- Oil prices still haven’t closed solidly above $50.00, and prices could break either way tomorrow. If they continue higher, $56.00 is my price cap before a lengthy correction.

Have a good night!