As a technical analyst, I formulate market opinions and anticipate price behavior that aligns with my interpretation. If things don’t unfold in as projected, then my outlook may need altering. Below are my current expectations.

If we are dropping into an 8-year cycle low, I’d expect to see increased selling in silver and miners going forward. Sharp declines will cancel the positive divergences and enhance the likelihood of a capitulation phase and panicked selling. A washout period would usher in the 8-year cycle low and reset sentiment. I’d like to see extended selling start within the next week or two confirming my analysis.

-US DOLLAR- The dollar traded down nearly touching the 10-day EMA but then rallied. Prices could be setting up for another advance. It would take a daily close below 102.50 to form a swing high and mark an early top.

-GOLD- I expected gold prices to bounce a little more by now. Prices need to close above $1,155 to neutralize the downtrend.

-SILVER- Prices have been unable to form a confirmed price swing (close above $16.16) and a bearish engulfing candle developed yesterday. If we are heading into an 8-year cycle low, I’d expect to see selling accelerate and a sharp move below $15.68.

-GDX- Prices rallied but closed near the lows for the day. Like silver, if we are dropping into an 8-year cycle low selling pressure should increase.

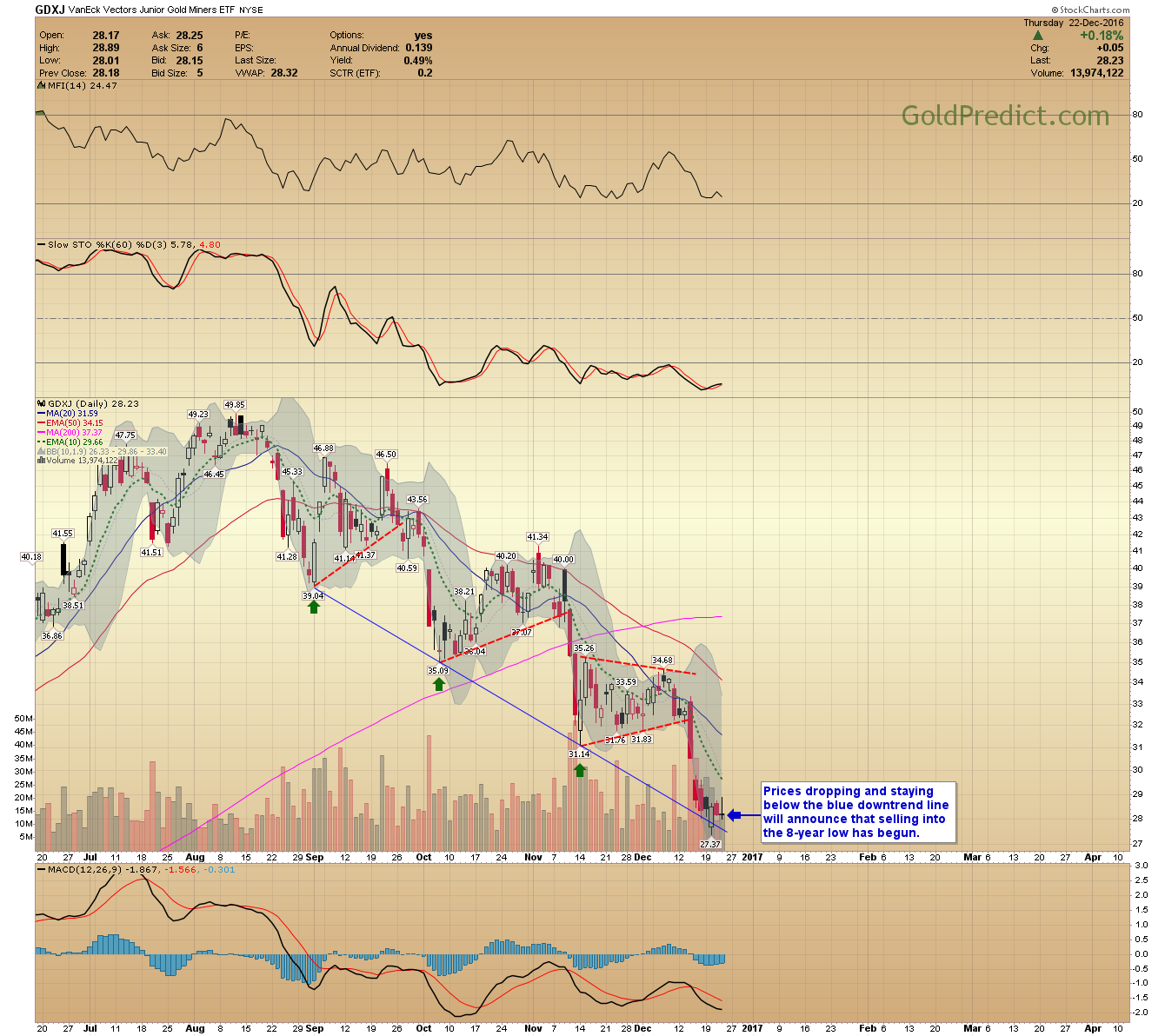

-GDXJ- Prices dropping and staying below the blue downtrend line will announce that selling into the 8-year low has begun.

-SPY- Stocks touched the 10-day EMA, similar to the dollar and may be ready for another advance. I don’t expect to see selling between now and yearend due to tax deferral.

-WTIC- Oil gave us our first sign of a potential top by forming a bearish engulfing pattern yesterday. I still expect a pullback into January potentially dropping between the 50-day and 200-day MA’s.

There are well-established downtrends in metals and miners. I will continue to look lower and expect to see hastened selling in the coming weeks. Silver dropping below $15.68 could ignite the selloff. If selling doesn’t increase, then we may be in for another consolidation zone.