The probabilities favor precious metals sinking further into a major 8-year cycle low. Traditional cycle timing suggests a bottom by the first quarter of 2017, most likely in February. If this is the case, then selling should expand during the next down leg; particularly in silver as it catches up to gold. Silver prices dropping below $15.68 should initiate a sharp decline.

Ideally, the current rally will terminate within a week or so before starting the next down leg. Gold prices closed lower for the seventh consecutive week and are well overdue for a positive close. We should get one this week. Nevertheless, precious metals are in clear downtrends and are likely to keep heading lower.

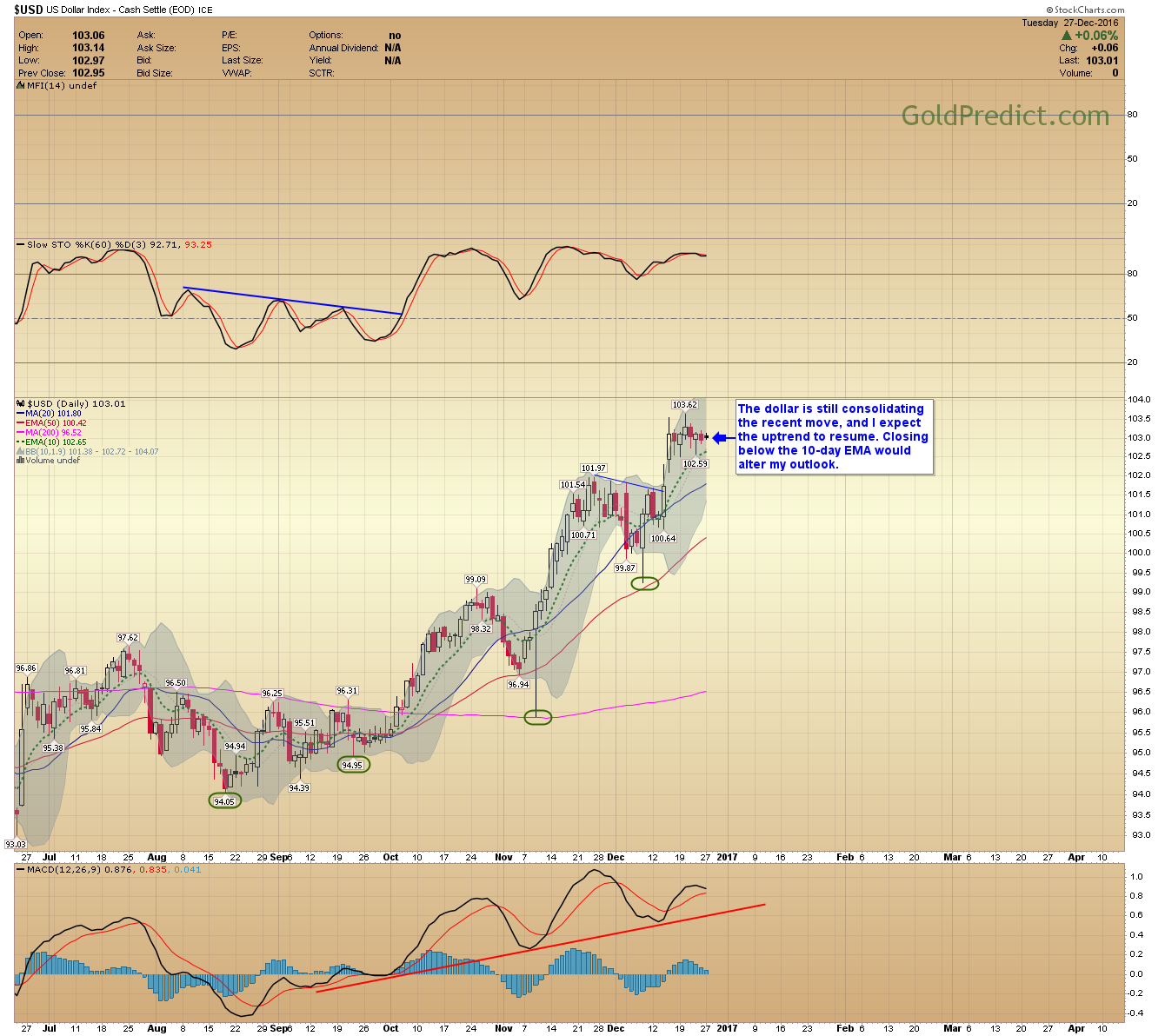

-US DOLLAR- The dollar is still consolidating the recent move, and I expect the uptrend to resume. Closing below the 10-day EMA would alter my outlook.

-GOLD- Prices rallied today, and it looks like we are finally getting a bounce. This rally should not exceed the $1,170 level before commencing the next leg lower.

-SILVER- Silver prices are also bouncing, and I’d like to see prices remain below $16.60. The next decline should include accelerated selling if we are dropping to an 8-year cycle low.

-GDX- Miners closed the gap that opened at $19.81, and prices could rally a little more. I’d like to see them remain below $21.00 before starting the next selloff.

-GDXJ- Junior miners closed above the 10-day EMA but need to reach $30.54 to close the open gap.

-SPY- Stocks are still consolidating, and trading volume is light. Prices need to close outside of the consolidation box for direction.

-WTIC- Prices made a new closing high and voided last week’s bearish engulfing pattern. I’m still expecting a correction to at least the 50-day EMA sometime in January.

Trading volume will remain light until after the new year. I’ll watch the markets closely and update as needed. I may look to short silver if a low-risk opportunity presents itself.