The correction I’ve been expecting is indeed delayed, but evidence still supports its arrival. Volume in metals and miners should increase as prices breakout to new highs; it hasn’t. Silver makes new intraday highs but then closes lower. And there was selling-in-strength today in GDX. Those factors are supportive of a top and not a genuine breakout.

Where prices close tomorrow is important. The non-farm employment numbers come out at 8:30 AM and that report could trigger a reaction in metals. The market anticipates 197,000 jobs for January. I’m not sure if healthy the ADP report will translate into significant numbers, but 240,000+ jobs should put pressure on gold. A number below 160,000 would support gold.

If/when prices top there should be a 1-2 week pullback. I will provide new correction objectives once the top is accepted.

-US DOLLAR- Prices traded down to 99.19 today but rallied in the afternoon. A close above the 10-day EMA will signal an interim low. The rebound still targets around 101.5.

-GOLD- Prices made a new cycle high but closed just below the $1,220 level. Where prices end tomorrow will aid in determining likely corrections targets.

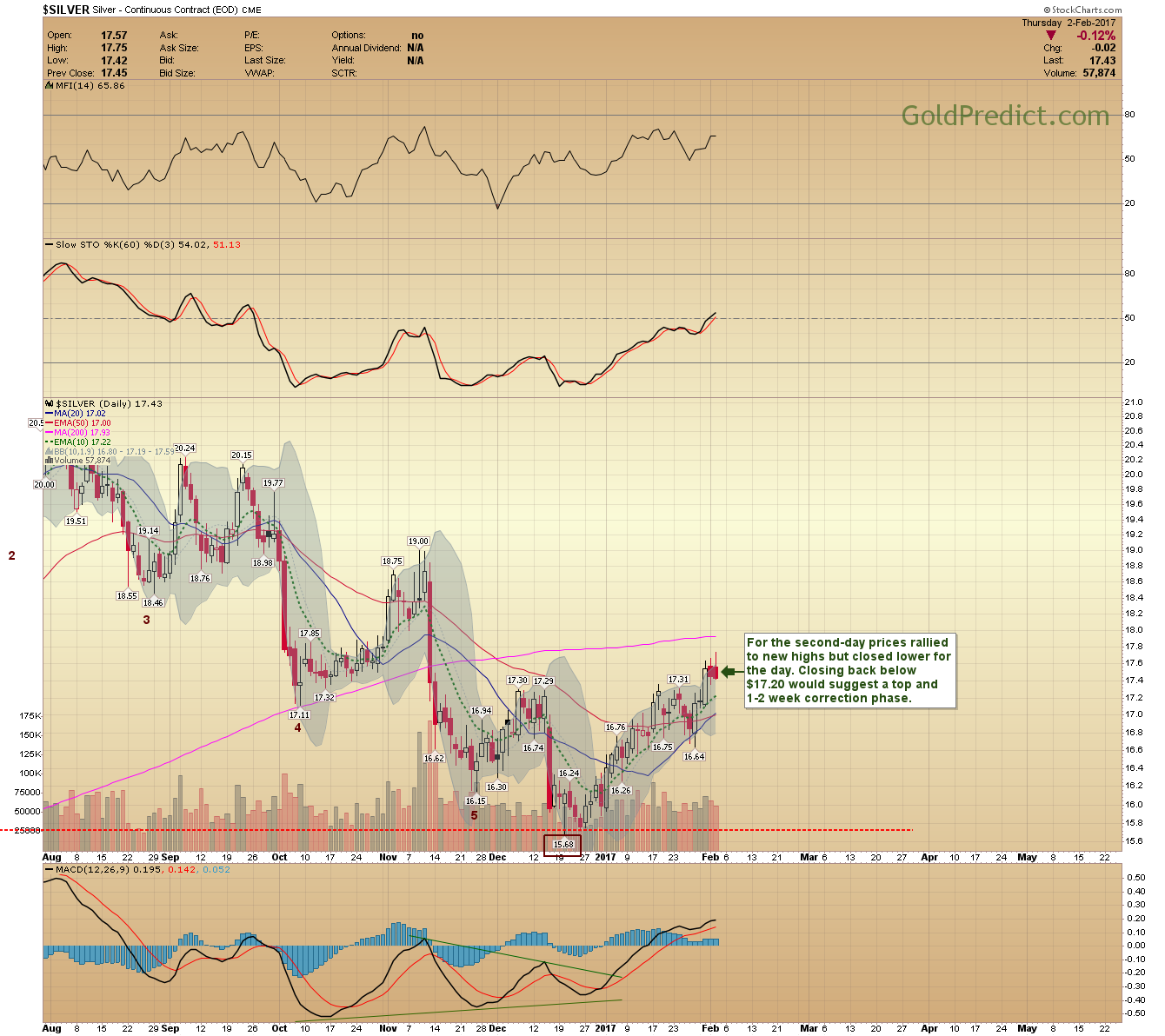

-SILVER- For the second day prices rallied to new highs but closed lower for the day. Closing back below $17.20 would suggest a top and 1-2 week correction phase.

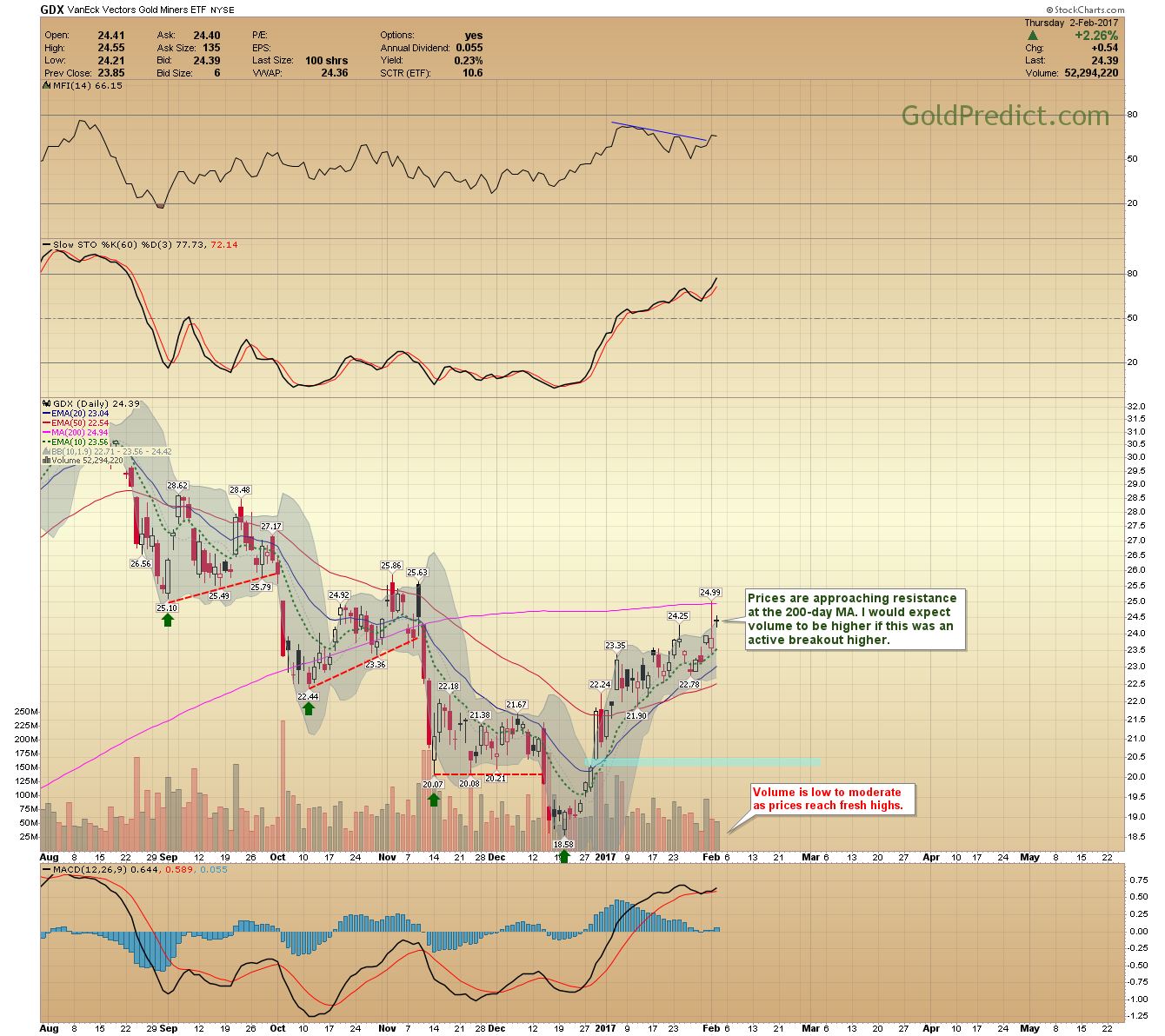

-GDX- Prices are approaching resistance at the 200-day MA. I would expect volume to be higher if this was an active breakout higher.

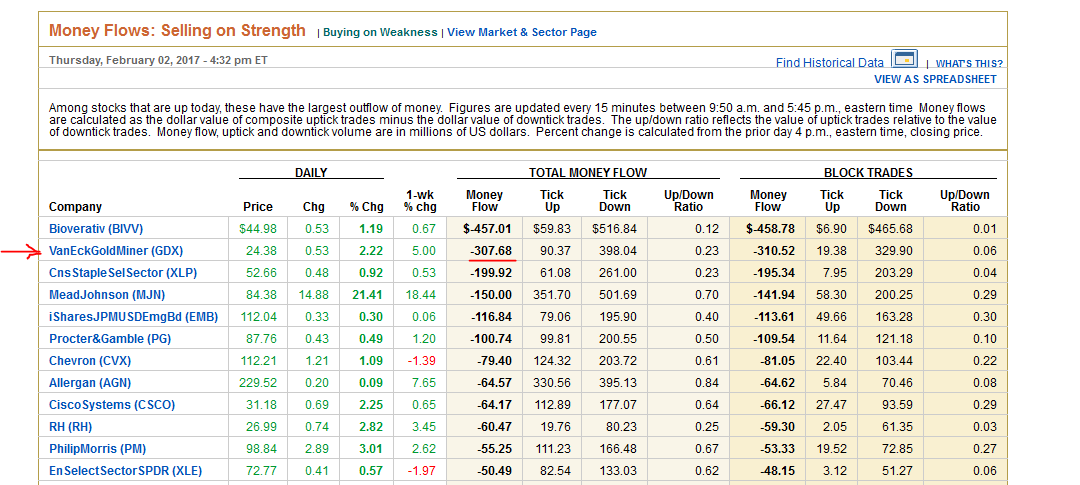

-SOS- The selling in strength numbers contradicts a breakout. Data provided by the WSJ.

-GDXJ- Prices closed above the 200-day MA, and the next resistance zone arrives between $40.00 and $41.00.

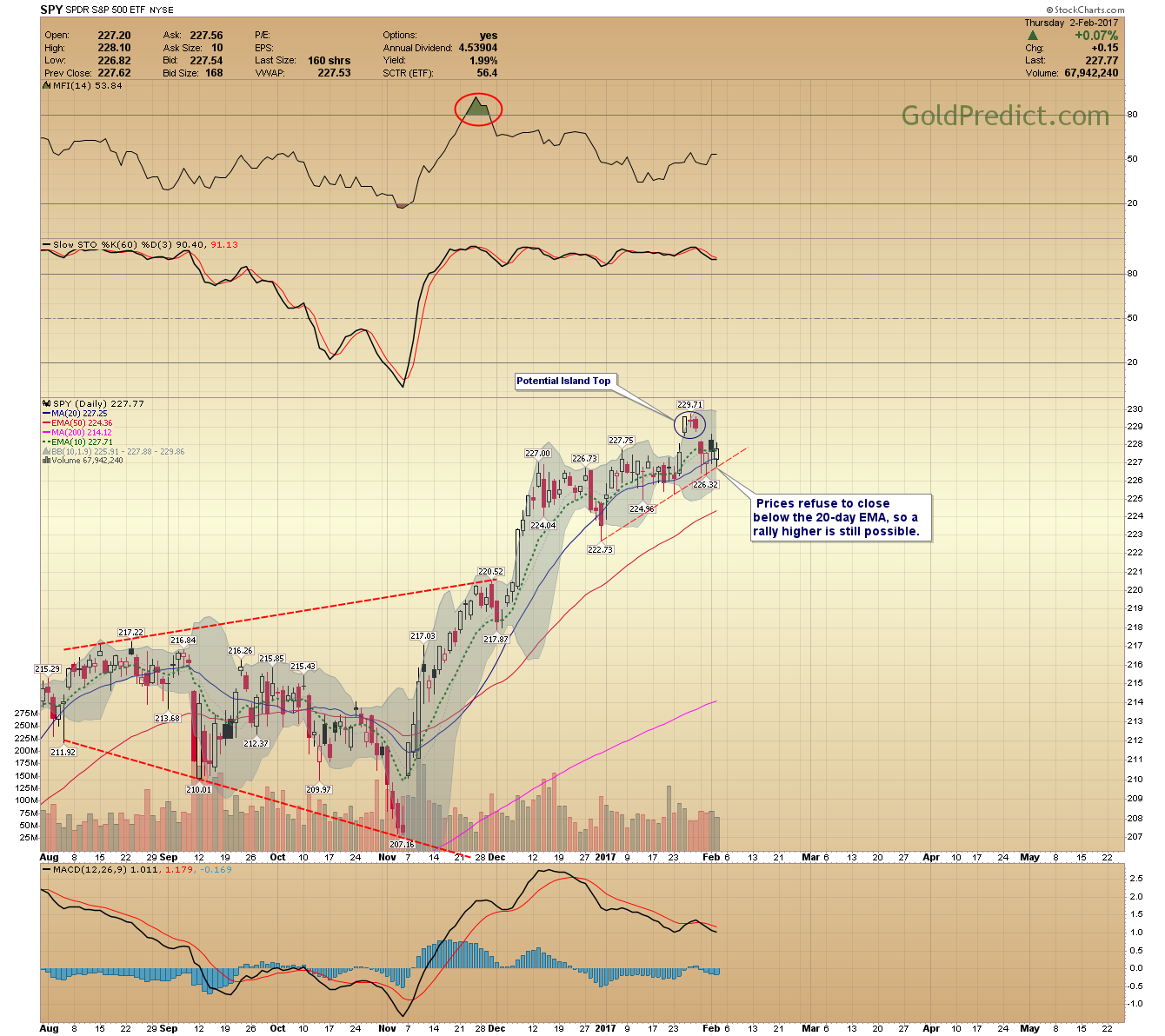

-SPY- Prices refuse to close below the 20-day EMA, so a rally higher is still possible.

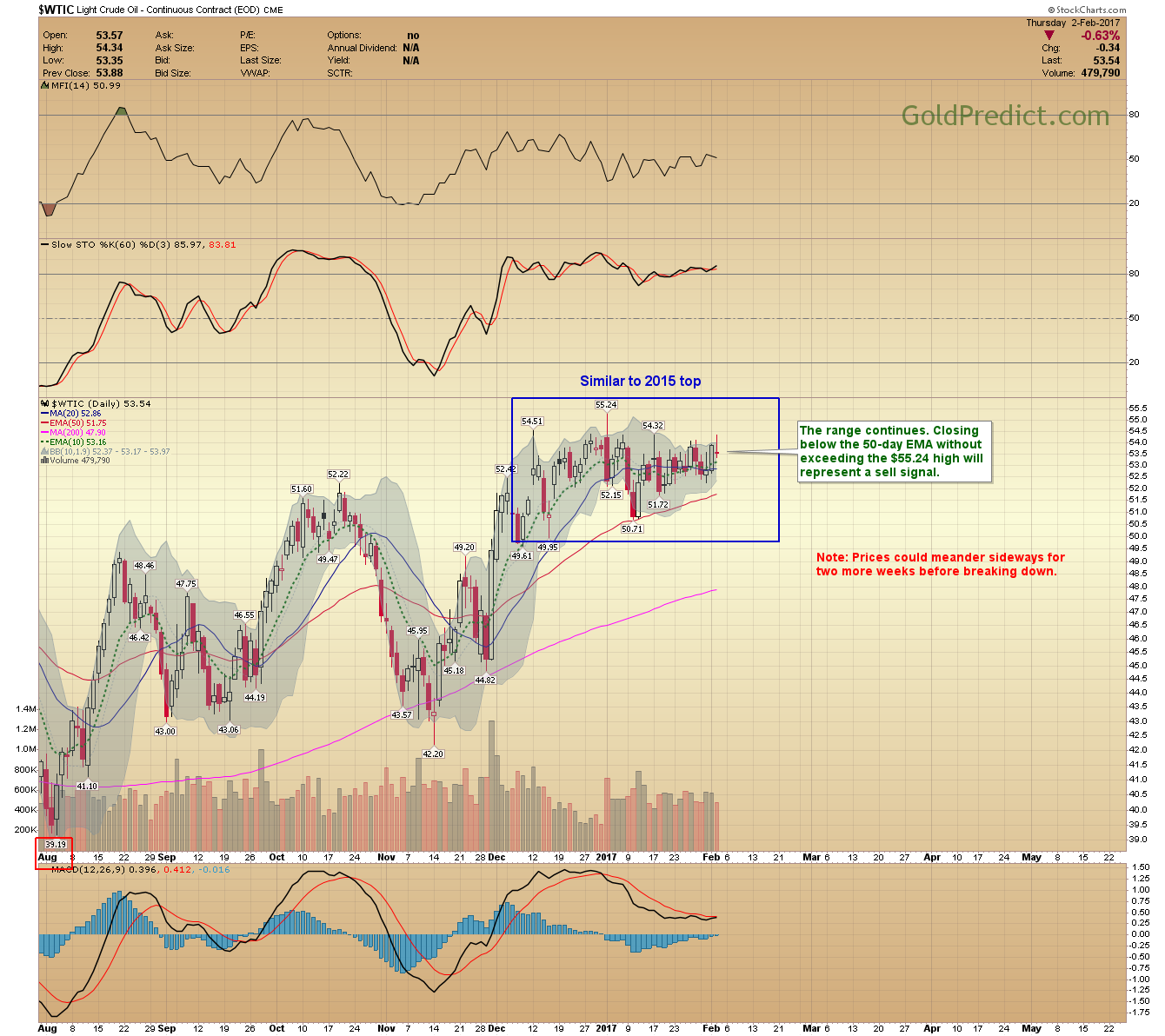

-WTIC- The range continues. Closing below the 50-day EMA without exceeding the $55.24 high will represent a sell signal.

I’ll update tomorrow morning if prices begin to shift significantly.