Gold was up slightly today, but silver and miners weakened.

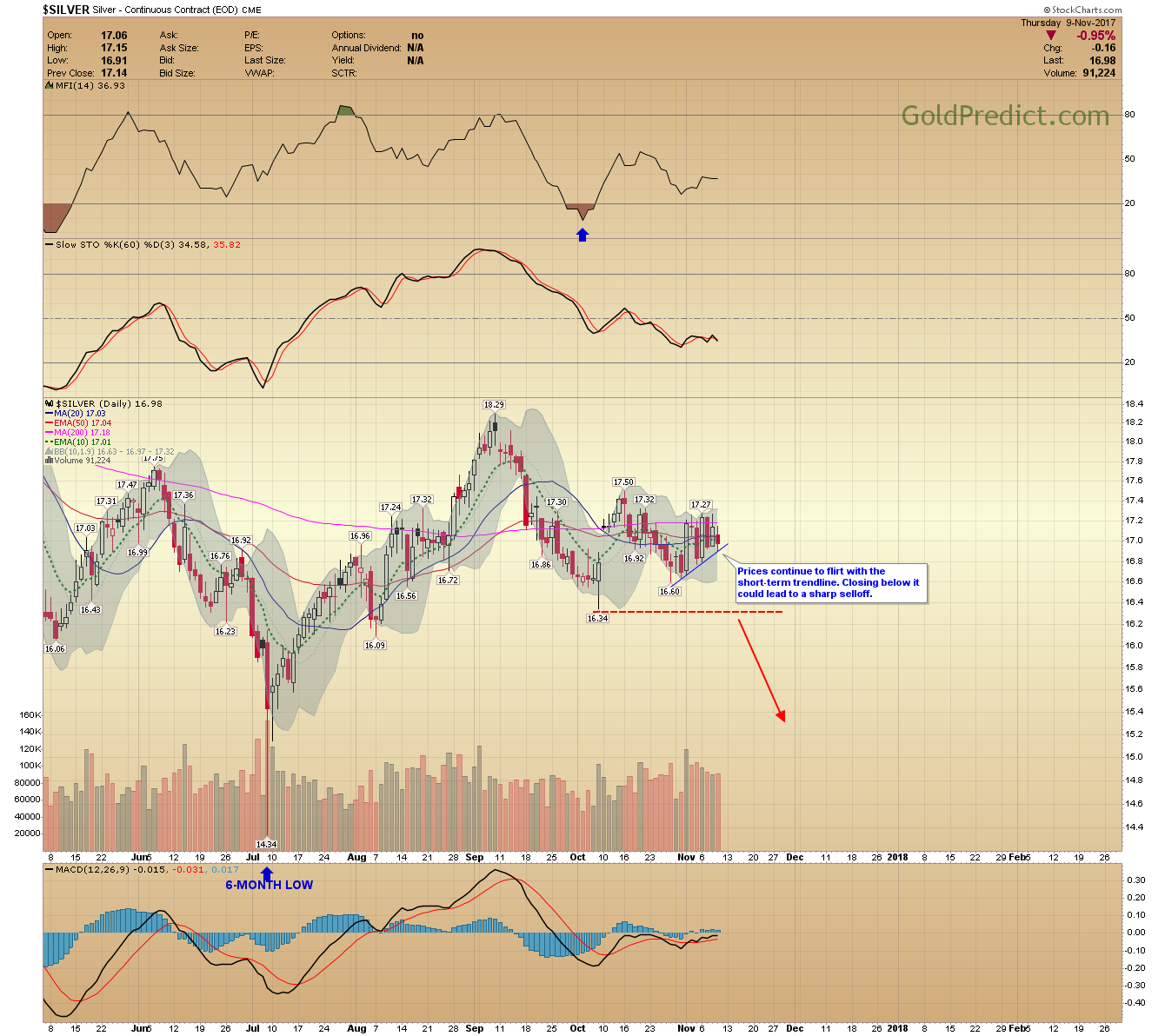

Silver is testing its short-term trendline, if broken, selling could expand. A breakdown below $16.90 and then $16.80 would confirm.

Miners look vulnerable. The XAU cycle has been running 21-24 trading days. The cycle may have switched (inverted) from marking lows to highs in September. If correct, miners could top this week. Notable downside follow-through next week will validate.

-US DOLLAR- The dollar has done little after breaking above the neckline. Prices must hold support between 93.75 – 94.00 to sustain a rally to the rebound objective.

-GOLD- It’s been 24-trading days since the previous low. The prior cycle peaked quickly, but prices neglected to break the October low. The trend is neither up nor down. Consequently, prices will remain rangebound until either the October high or low is broken.

-SILVER- Prices continue to flirt with the short-term trendline. Closing below it could lead to a sharp selloff.

-XAU- I’ve been watching the XAU mining index. It’s possible the cycle switched to highs in September. If correct, a cycle top between 11-8 (yesterday) and 11-10 (Friday) would support a 21-23 day cycle configuration. A daily close above 82.95 would invalidate this argument.

-GDX- Technically, prices formed a small swing high. Closing lower tomorrow would tip the scale toward the bears. A daily close above $23.02 would extend the rebound.

-GDXJ- Juniors are holding the bearish flag pattern. Flag patterns rarely last more than two weeks. If the bearish structure is going to trigger, prices need to breakdown soon.

-SPY- Prices soldoff but buyers rushed in. There is compelling momentum to the upside. Prices would have to close consecutively below the upper trend channel to propose a correction.

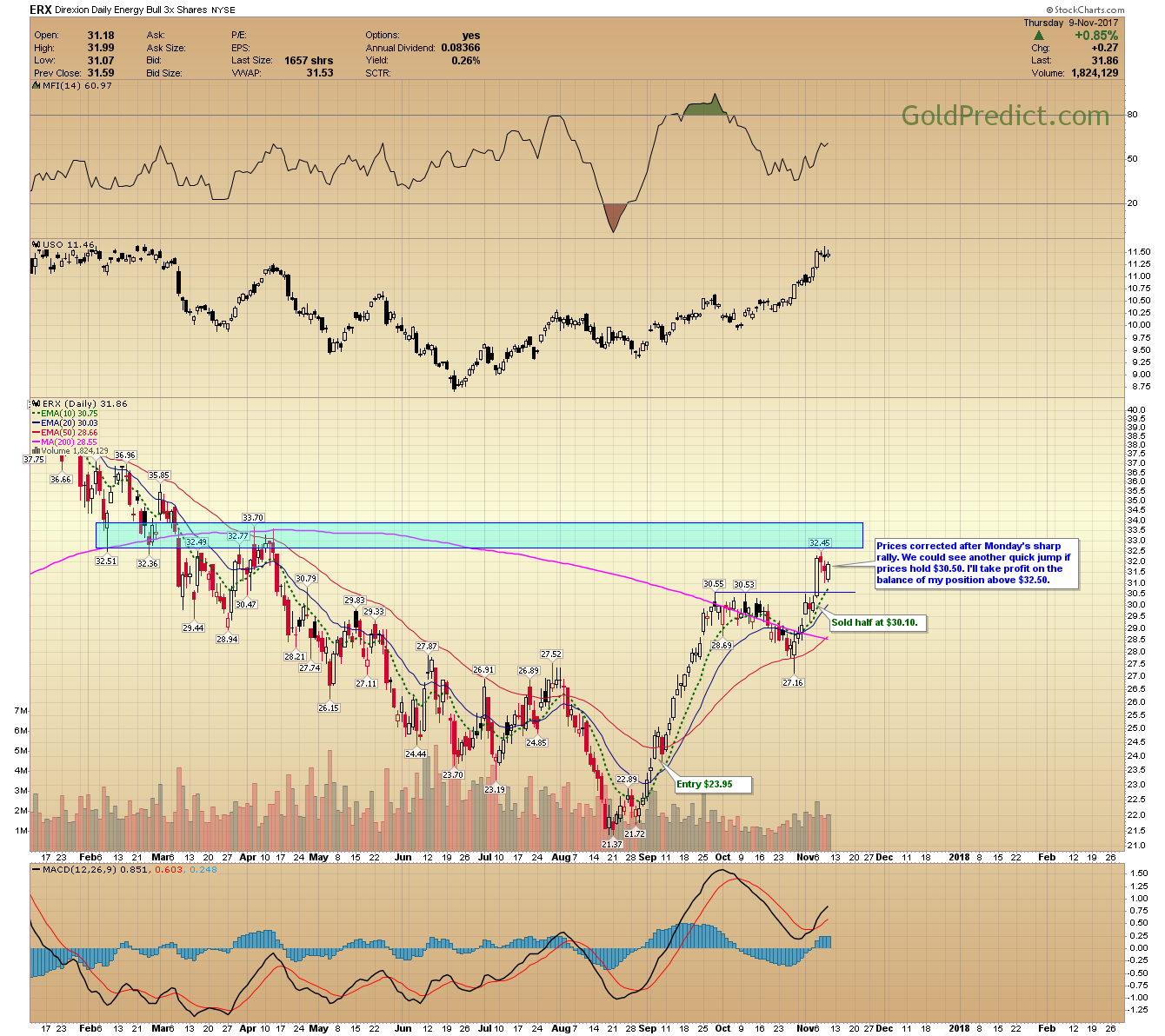

-WTIC- Prices are consolidating after breaking above $55.00. We could see one more quick thrust above $58.00. The 200-week MA sits at $58.85. The MFI is oversold, and prices could top within the next few trading days.

-ERX- Prices corrected after Monday’s sharp rally. We could see another quick jump if prices hold $30.50. I’ll take profit on the balance of my position above $32.50.

Have a great night. The Weekend Newsletter will be out Saturday.